Lagos – Nigeria’s oil producing states received N99.474 billion Derivation Revenue for August, being the 13% derivation fund as prescribed by law.

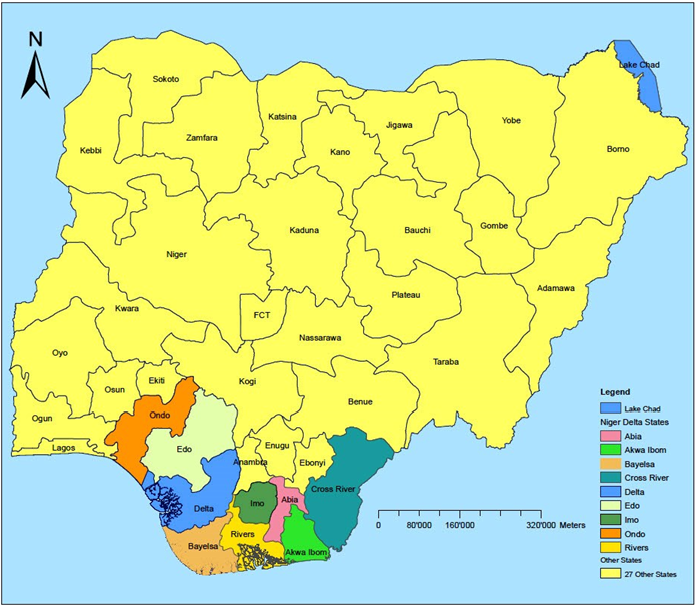

The oil producing states are Akwa Ibom, Delta, Rivers, Bayelsa, Imo, Abia, Ondo, Anambra, Edo and Lagos.

The amount received by them is part of the total N1.203 trillion disbursed by the Federation Account Allocation Committee, FAAC, to the three tiers of government as federal allocation for the month of August 2024 from a gross total of N2.278 trillion.

A communique issued by the FAAC at the end of its meeting in Abuja, said the total amount shared by the three tiers of government and disbursed to the minerals producing states is inclusive of gross statutory revenue, value added tax, electronic money transfer levy and exchange difference.

The Federal Government received N374.925 billion, the states, N422.861 billion and the local government councils, N306.533 billion, while the oil producing states received N99.474 billion as derivation – 13% of mineral revenue.

The sum of N81.975 billion was given for the cost of collection, while N992.617 billion was allocated for Transfers Intervention and Refunds.

The communique by FAAC indicated that the Gross Revenue available from the Value Added Tax for the month of August 2024 was N573.341 billion as against N625.329 billion distributed in the preceding month, resulting in a decrease of N51.988 billion.

From that amount, the sum of N22.934 billion was allocated for the cost of collection and the sum of N16.512 billion given for Transfers, Intervention and Refunds.

The remaining sum of N533.895 billion was distributed to the three tiers of government, of which the Federal Government got N80.084 billion, the States received N266.948 billion and Local Government Councils got N186.863 billion.

Accordingly, the gross statutory revenue of N1.221Trillion received for the month was lower than the sum of N1.387 received in the previous month by N165.994. From the stated amount, the sum of N58.415 Billion was allocated for the cost of collection and a total sum of N976.105 billion for transfers, intervention and refunds.

The remaining balance of N186.636 billion was distributed as follows to the three tiers of government: Federal Government got the sum of N71.624 billion, States received N36.329 billion, the sum of N28.008 billion was allocated to LGCs and N50.675 billion was given to Derivation Revenue (13% mineral producing states).

Also, the sum of N15.643 billion from electronic money transfer levy was distributed to the three tiers of government as follows: the Federal Government received N2.252 billion, states got N7.509 billion, Local Government Councils received N5.256 billion, while N0.626 billion was allocated for cost of collection.

This article was originally posted at sweetcrudereports.com

Be the first to comment